Distributions is actually, naturally, nonexempt as normal money that can end in a high income tax bracket

The Rule off 55

A unique penalty-100 % free treatment for take 403(b) withdrawals ‘s the Rule out of 55, which applies if 403(b) professionals get off their job (willingly otherwise involuntarily) throughout the otherwise following the calendar year they turn 55. In such a case, they can elect to retire very early and you can withdraw some otherwise all the of their offers in the a lump sum payment.

Not all the 403(b) preparations ensure it is Rule away from 55 withdrawals, however, as they can hinder staff retention efforts. Additionally there is a danger that former employees you may mismanage their distributions and you may use up all your money. A switch position would be the fact deals need stay static in a recent employer’s decide to create penalty-free distributions. It cannot end up being rolling over into a keen IRA.

Volunteer Punishment-Free Benefits

Early detachment punishment prevent from the years 59? and you can necessary RMDs start in the years 72. Just what 403(b) users create due to their membership anywhere between those two years are right up in it. Secret parameters to look at whenever determining when to begin taxable distributions is monetary you desire, health status, balance (can it you want more time to grow?), most other sourced elements of old-age earnings (elizabeth.g., a pension), and you may projected upcoming https://cashadvancecompass.com/loans/disability-payday-loans/ tax group.

Affluent retired people having multiple earnings channels could possibly get elect to initiate distributions from 403(b)s or any other taxation-deferred agreements inside their 1960s to reduce account balance and you will pass on tax repayments more longer frame.

Requisite Minimal Withdrawals

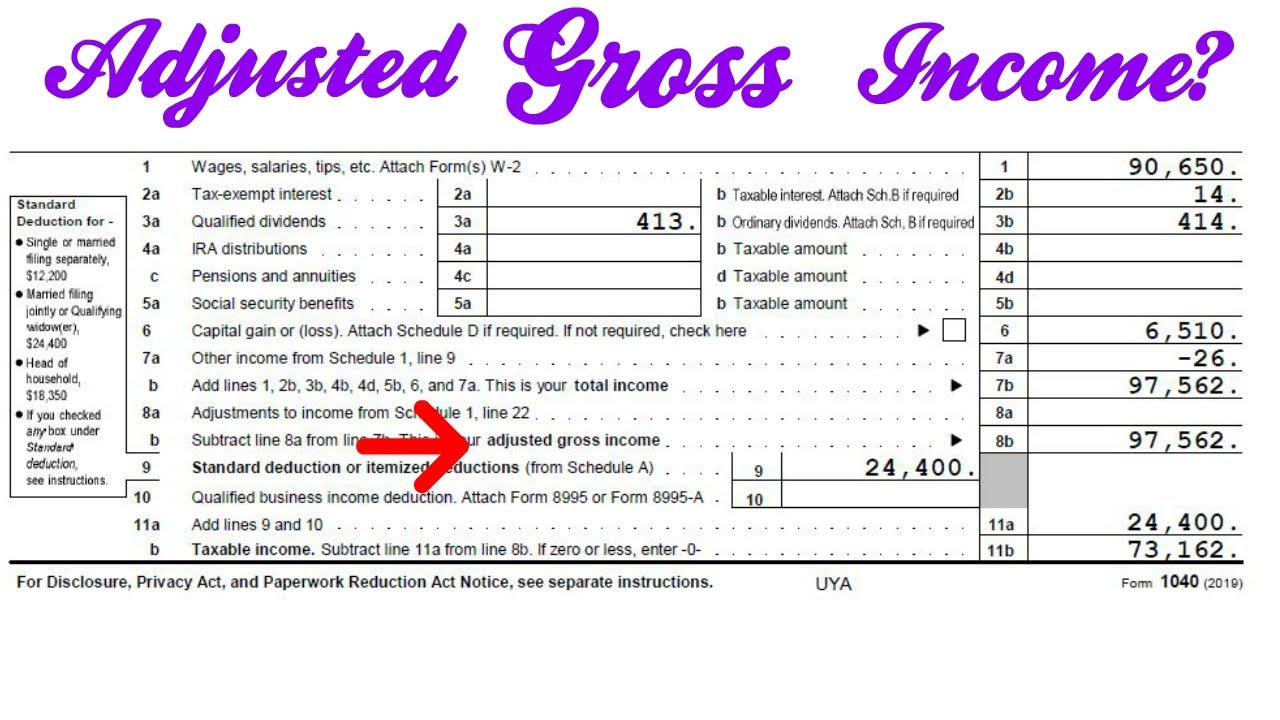

RMDs must start during the age 72 consequently they are put into taxable normal income. There are two key times: December 29 (the fresh new due date for routine yearly RMD distributions) and you may April hands down the seasons after the season someone transforms 72 (expected beginning date to have very first RMD). In order to determine RMDs, taxpayers split the bill within 403(b) membership to your December 29 of the early in the day 12 months by the compatible divisor because of their age.

Based measurements of good 403(b) harmony, RMDs can boost the newest nonexempt income (and you may income taxes) out of retired people moderately or sufficient to transfer to a top tax class. Appropriate income tax withholding is essential. It can be vital that you get RMD calculations best. Or even, the Internal revenue service charges a substantial penalty equivalent to 50 % of extent that should was in fact applied for however, was not.

Other 403(b) Withdrawals

Handicap and Demise – Along with money, difficulty withdrawals, and distributions on break up out of an employer, 403(b) members can also withdraw currency penalty-totally free once they end up being handicapped otherwise has scientific costs you to definitely meet or exceed eight.5% regarding adjusted revenues. Whenever they pass away, its beneficiaries will get distributions.

Leaving a detrimental 403(b) Package – A great deal more an exchange than a detachment, 403(b) participants which get off a top-prices supplier which have pricey, commission-situated factors as well as move currency. 403bwise possess step-by-action recommendations on the best way to do that.

Roth Account Distributions – Roth 403(b) membership can only just become rolling out over other Roth account- perhaps not pre-tax levels. There aren’t any fees and you can punishment due with the Roth 403(b) income distributions when membership owners turn 59? and get had a be the cause of about five tax many years.

Search Results

Whenever accumulating money during functioning decades, that isn’t strange for 403(b) professionals to drop to their accounts. You to data found that more than twenty-five% out of houses drop towards old age offers preparations. Leakage from old-age plan assets getting non-old-age motives number in order to $60 mil a year, reflecting the need for an urgent situation finance and later years savings. Decreased emergency offers getting financial shocks such as for instance scientific bills and you will automobile fixes was firmly for the breaching old-age profile.

To the decumulation side, a survey examined strategies to mark off old-age accounts to quit often outliving savings otherwise scrimping on paying. This new comparison discovered playing with RMDs, according to endurance, does as well as other methods (age.g., using merely income) and also outperforms the better-publicized 4% Laws. Research has and additionally found that RMD statutes has important consequences to the savings withdrawals.