If this is the first occasion you’ve observed a first-lien family security personal line of credit (HELOC), you’re not by yourself

This mortgage device makes you use the equity on your own where you can find pull out a good rotating credit line. An initial-lien HELOC is a particular version of HELOC that will replace your current home loan.

Benzinga Mate Look for a loan provider Get a purchase otherwise Refinance Quote Get the most from your own mortgage company. Start out with you buy or refinance into the moments! Pick a loan provider Dining table regarding Articles

- Facts Earliest-Lien HELOCs

- How come a first-Lien HELOC Work?

- Positives and negatives

- Come across The 19 Activities

Knowledge Very first-Lien HELOCs

Good HELOC is a kind of financing you to definitely home owners may use to access the guarantee inside their land and that is tend to utilized to help combine obligations or loans home solutions. Normally, an excellent HELOC is taken out since a secondary little bit of financing and additionally home financing. The original-lien HELOC are a new brand of a home loan you to definitely bundles a mortgage and you can a HELOC to the a single obligations.

Why does an initial-Lien HELOC Work?

Earliest, know about liens. A good lien to your a home lets the latest lienholder to help you recover the latest assets in case your homeowner/debtor cannot repay the mortgage. When you take aside home financing, the financial institution ‘s the lienholder, if in case your standard on the financial, the lender provides the straight to allege the property.

HELOCs are in the second-lien reputation, acting as a 2nd mortgage. As a result in case the resident defaults on their mortgage and you may this new HELOC, the loan lender’s lien must be satisfied through to the HELOC usually be distributed of.

A first-lien HELOC substitute the latest homeowner’s financial. Since the an excellent HELOC try an effective revolving credit line, you could withdraw funds from they to repay the rest equilibrium of one’s new home loan. Then you will enter the installment several months towards HELOC. Due to the fact a great revolving credit line, you can continue to withdraw money from this new HELOC since you repay your balance.

Such, state personal loans in Nevada for bad credit you have got five years remaining into a good fifteen-seasons fixed home loan. You could remove a good HELOC and employ it to spend off the remaining harmony of one’s totally new financial. Because you pay the new HELOC, you will have use of fund that can be used making repairs with the domestic or even funds most other expenses. You might also take-out a primary-lien HELOC if you’ve reduced the home loan and want to use your domestic once the equity getting an effective rotating personal line of credit.

Positives and negatives

A first-lien HELOC can be useful in lot of facts. But not, it’s not the best selection for folks. Take into account the pros and cons before generally making the decision.

Pros

- Could possibly offer lower interest levels compared to the brand-new financial

- Mark months allows you to access money for many years

- Alot more freedom than simply antique mortgages

Cons

- Needs one to make use of house because the guarantee

- Changeable interest rates renders cost management to own money difficult

- Settlement costs may costly

Criteria

The requirements to help you qualify for a first-lien HELOC resemble what you would have to be accepted to possess home financing. Lenders’ criteria will vary, nevertheless they will select a credit score regarding 680 or even more and you can a personal debt-to-earnings proportion that will not surpass forty-five%.

Ways to get a first-Lien HELOC

Step one: Research lenders If you’ve decided you to a primary-lien HELOC is right for you, step one try comparing loan providers. Only a few lenders offer basic-lien HELOCs, very like a number of who do and you will contrast them. You might find the financial we need to work with.

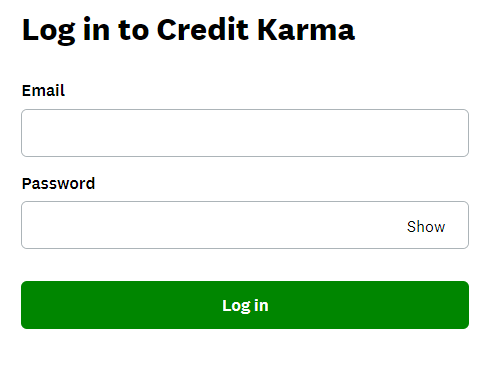

Step two: Implement Apply at your chosen bank. Definitely include all of the documentation needed to procedure your application.

Step three: Stay static in contact The first-lien HELOC goes from underwriting processes. Be sure to stay in exposure to your financial and that means you normally address one wants even more files punctually.